When President Donald Trump was sworn into office on Jan. 20, a significant shake-up in federal policy was expected. A House Ways and Means Committee memo circulated by Republican lawmakers provides a 50-page list of potential options for budget reconciliation.

One of the proposals reads, “Credit unions are exempt from federal income taxes on their earnings. This option would subject credit unions to the federal income tax.”

This, of course, would be a massive disruption to credit unions and how they operate.

Earning the Credit Union Tax Exemption

Credit unions are tax-exempt because they serve an important function in the community. As member-owned, not-for-profit financial institutions, credit unions’ primary focus is to return benefits to the members. Through democratically elected leadership, credit unions can provide benefits such as better interest rates than other financial institutions. This benefit can also transfer to nonmembers, as other financial institutions alter their rates to remain competitive in the market. Thus, by providing enhanced market competition, credit unions serve as a governor of pricing and practices across all financial services providers.

Amid political uncertainty, credit unions must advocate for retaining their protected tax status to protect the value of the not-for-profit business model. They must also demonstrate that they are fulfilling their objective of giving back to the communities they serve.

Employee volunteer work and donations are an excellent way to demonstrate your credit union’s work in the community and help to maintain the credit union tax exemption. To encourage volunteering, 65% of businesses provide paid time off for employees doing community service work. Additionally, credit unions can implement programs such as skills-based volunteering, where professionals lend their skills to charitable organizations for no cost, or volunteer grants, where companies donate to charities after employees have volunteered a certain number of hours.

Administering Your Employee Giving Program

Administering a program like this across dozens, if not hundreds or thousands of employees located across the nation and around the globe can create a huge headache. Leverage technology as your aspirin!

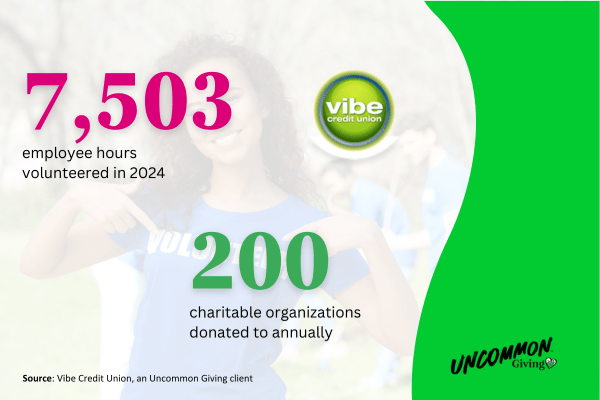

Vibe Credit Union in Michigan stands out as an exemplary instance of credit unions fulfilling their community purpose. With a stated vision “to elevate community and create opportunity,” Vibe donates to more than 200 charitable organizations annually, and Vibe employees volunteered 7,503 hours in 2024, up from 6,300 hours the year prior.

After implementing Uncommon Giving’s software, Vibe experienced a notable positive transformation in their volunteering programs. Plus, the credit union is using the data to show its bonafides as a pillar of the community. Read more about it here!

Why Track Your Give-at-Work Program?

Three key reasons for why it is essential for your credit union should be accurately tracking community engagement rise to the top.

- Lobbying. With so much legislative uncertainty, lobbying is key for the continued success of credit unions. Organizations such as the Defense Credit Union Council and America’s Credit Unions are urging credit unions to write letters to their members of Congress. Having accurate, tangible data about the social good your credit union is doing for the community goes a long way in demonstrating the necessity of keeping credit unions exempt from federal taxes and focused on serving their communities.

- Public relations. Having demonstrable facts about the social benefit your credit union brings to the community it serves builds rapport and positive brand association that are critical in times like these to build grassroots support and community advocacy.

- Compliance. The extra 30%, give or take, of income that isn’t going to federal income tax allows credit unions to invest back into their communities. This is particularly important for Community Development Financial Institution-certified credit unions, which must report to the CDFI Fund on their community development activities to maintain certification and access to apply for grants. Keeping close track of your credit union’s community giving is perfect for CDFI credit unions to demonstrate compliance.

Credit unions’ give-at-work programs (or any financial services business) illustrate to lawmakers that you are serving your intended social function and the existing business model should not be changed.

We’d love to help your credit union ensure its future. Reach out to Uncommon Giving now!

A version of this article was originally published in The Credit Union Connection.