All banks in the United States must follow the Community Reinvestment Act (CRA) compliance requirements. On the other hand, credit unions are not forced to comply at the federal level (although a select number of states do require it at that level). However, they can still benefit from serving lower-income and historically disadvantaged communities for Community Development Financial Institution (CDFI) or NCUA’s Low-Income Credit Union designation (LID) reporting.

What is CRA?

CRA is a law that requires financial institutions to meet the credit needs of the communities they serve. To do so, they are required to use the funds from the communities to help develop them, with a focus on providing services to low—and moderate-income (LMI) individuals.

While all banks must follow CRA compliance requirements, most credit unions are exempt because they were created with serving the community in mind. However, there is still some debate as to whether all credit unions should be under CRA, so it can’t hurt to prove your credit union already supports the community it serves.

What Qualifies for CRA Compliance?

A variety of activities and programs that credit unions and their employees participate in can qualify for CRA, CDFI or LID compliance, including:

Volunteering

Volunteer work is one of the best ways to get your financial institution involved in the community. Volunteer activities that qualify for CRA include donating to food pantries and helping out at homeless shelters. Nonprofits supporting copious causes are out there, so your employees are sure to find one that aligns with their and your credit union’s values, which can lead to the added benefit of boosting the morale of your staffand creating a more unified and committed team overall.

Financial Assistance and Education

If there’s one thing community banks and credit unions are great at, it’s helping people make the most of their finances. Providing financial education and assistance are two great ways to improve members’ financial health while also engaging with and building trust within the community. One way that will count for CRA credit is hosting financial education workshops that cover different financial topics that are open to and help everyone from children to adults. Banks and credit unions can also support and volunteer with nonprofits that provide income tax assistance to LMI individuals.

Other Qualifying Programs

- Youth mentoring and tutoring programs

- Construction of affordable housing

- Supporting LMI-focused drug and alcohol recovery centers

- Assisting state-funded battered women’s shelters

- Supporting nonprofit training centers that provide job training programs and workforce development for unemployed individuals

Don’t Forget to Document Everything!

While donating, volunteering and working alongside nonprofits are critical for your community and compliance, one must not forget one more crucial step: documenting all these activities. Without properly documenting events you’ve participated in, your organization cannot prove you’ve met the CRA, CDFI or LID criteria. While the precise location of where the volunteering takes place does not matter, it’s essential that the volunteer work primarily benefits LMI communities and individuals.

While compliance is required, there’s no denying the benefits to the community – and your more highly engaged team – from contributing and participating in activities that qualify for CRA, CDFI or LID compliance. (And, for credit unions located in Connecticut, Illinois, New York, Massachusetts, Rhode Island, and the District of Columbia, which require them to follow CRA, we will share some guidelines for you soon, so stay tuned!)

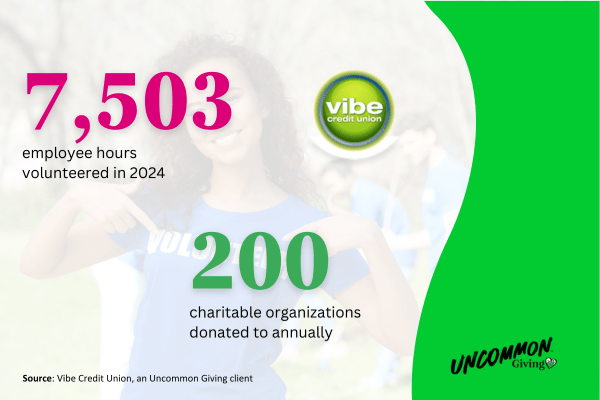

Frequently, the failure of employee-giving programs falls at the feet of the headache of administration or lack of attention. Leveraging the Uncommon Giving technology platform helps your financial institution promote employee participation in support for nonprofits and document it with reporting and photos all in one place regularly.